more WORKS

more WORKS

CASHBACK

CASHBACK

CASHBACK

T-BANK TRAVEL

T-BANK TRAVEL

T-BANK TRAVEL

SENIOR DESIGHER

SENIOR DESIGHER

SENIOR DESIGHER

2024

2024

2024

Summary

Summary

Summary

Problem

Problem

Problem

Cashback was hidden until checkout. About 30% of support inquiries were related to cashback.

Cashback was hidden until checkout. About 30% of support inquiries were related to cashback.

Cashback was hidden until checkout. About 30% of support inquiries were related to cashback.

Goal

Goal

Goal

Increase loyalty and improve booking conversion by integrating cashback visibility early in the flow, standardizing benefit presentation across services, and reducing support load.

Increase loyalty and improve booking conversion by integrating cashback visibility early in the flow, standardizing benefit presentation across services, and reducing support load.

Increase loyalty and improve booking conversion by integrating cashback visibility early in the flow, standardizing benefit presentation across services, and reducing support load.

What was done

What was done

What was done

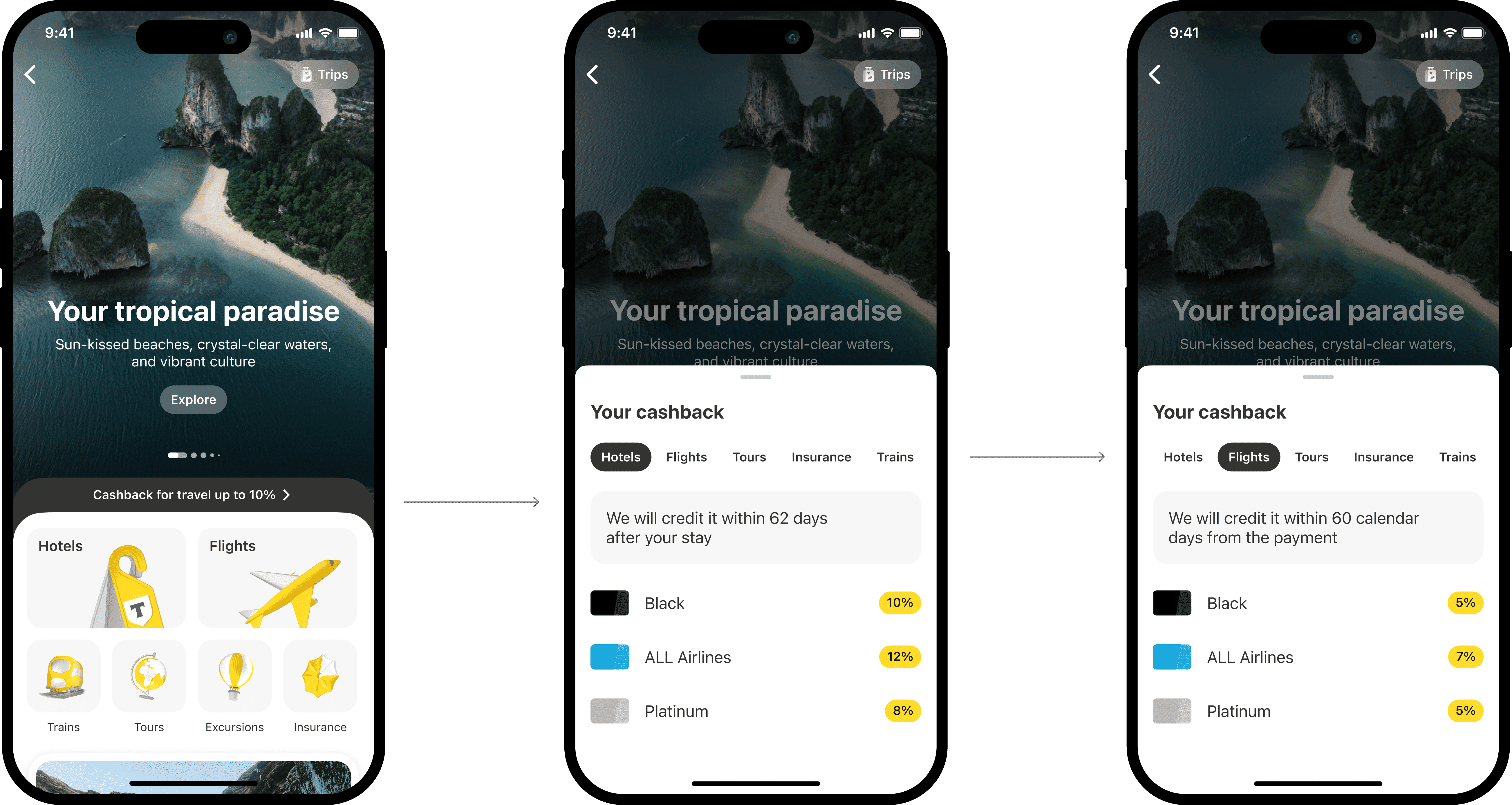

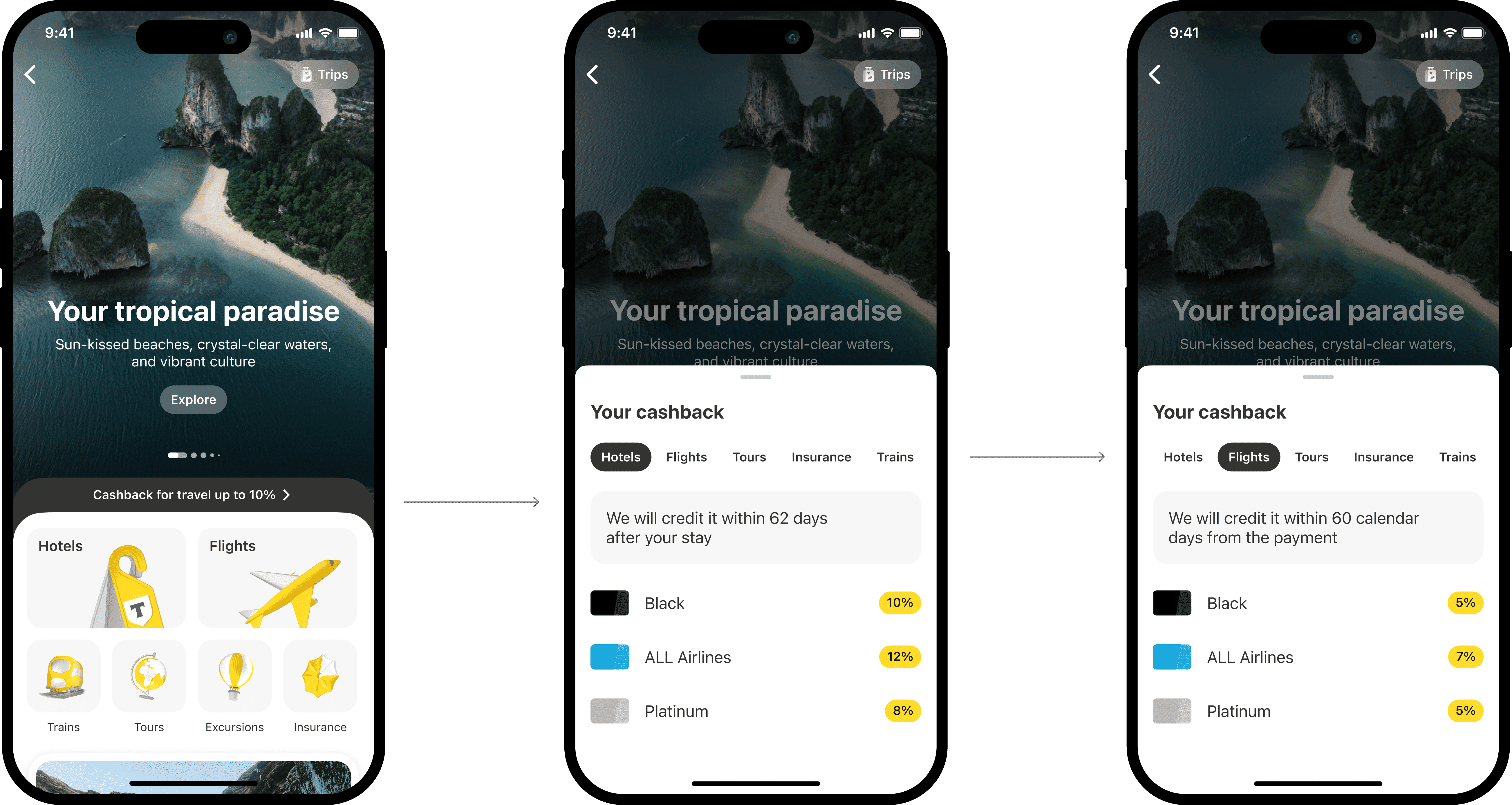

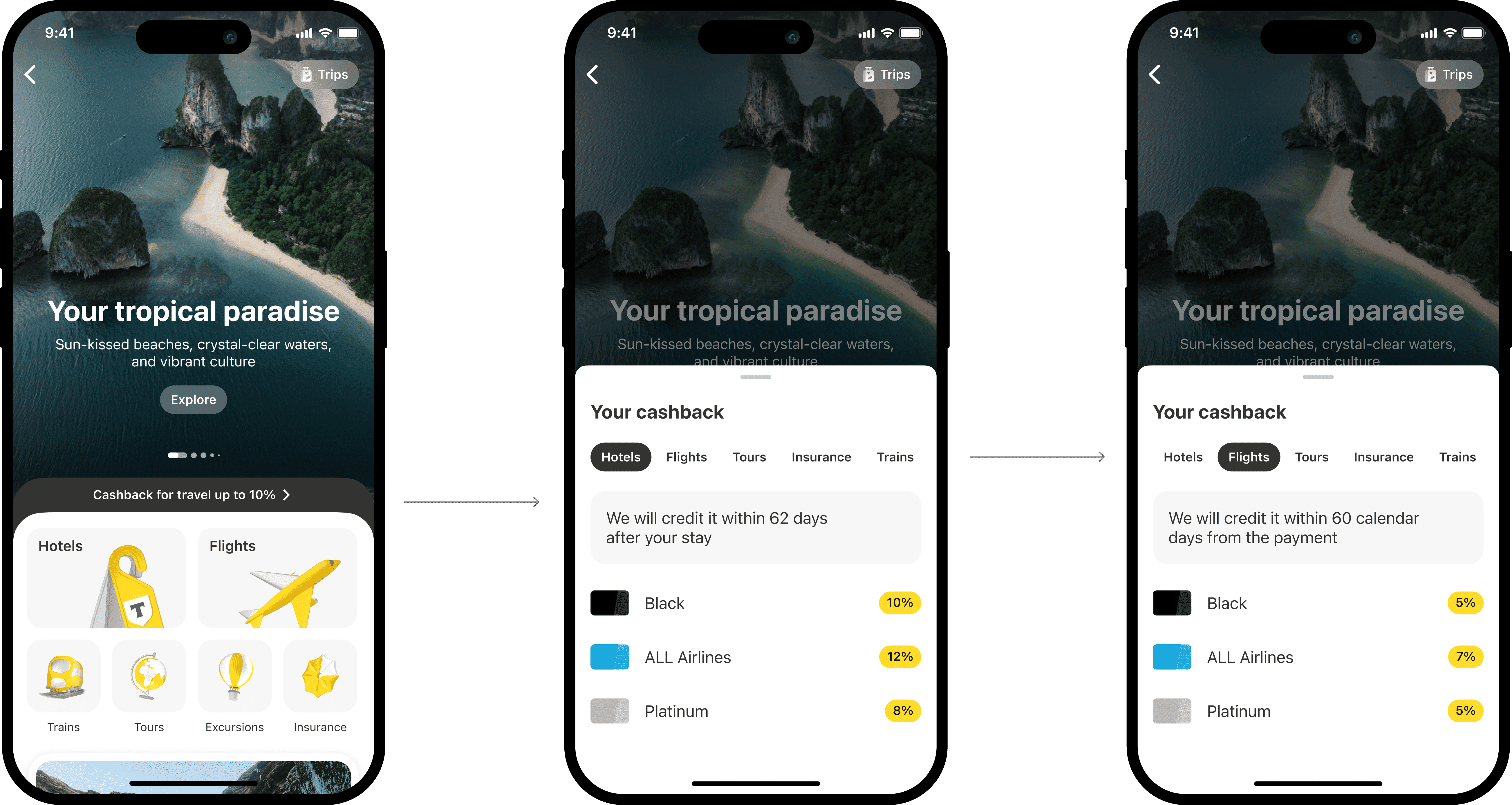

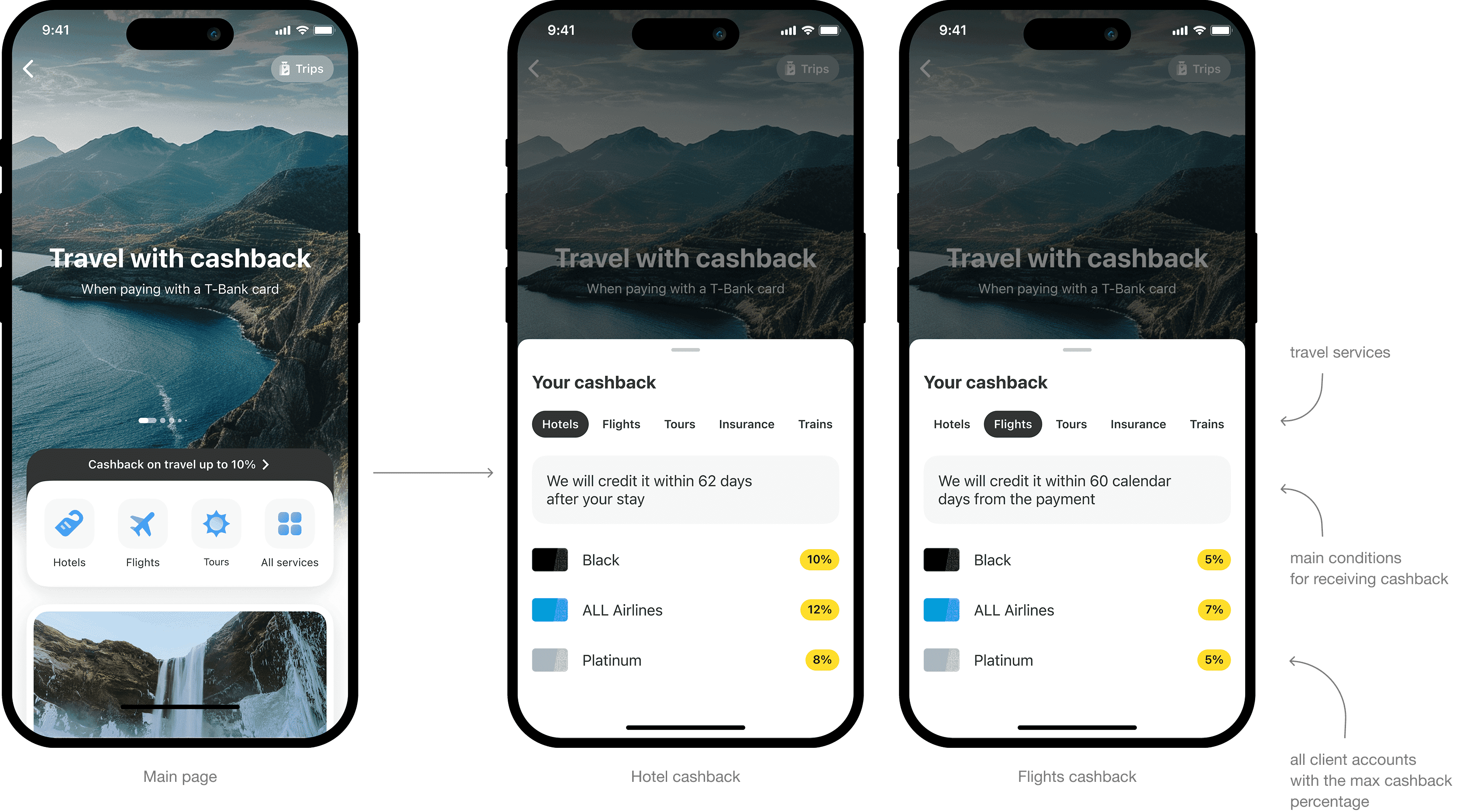

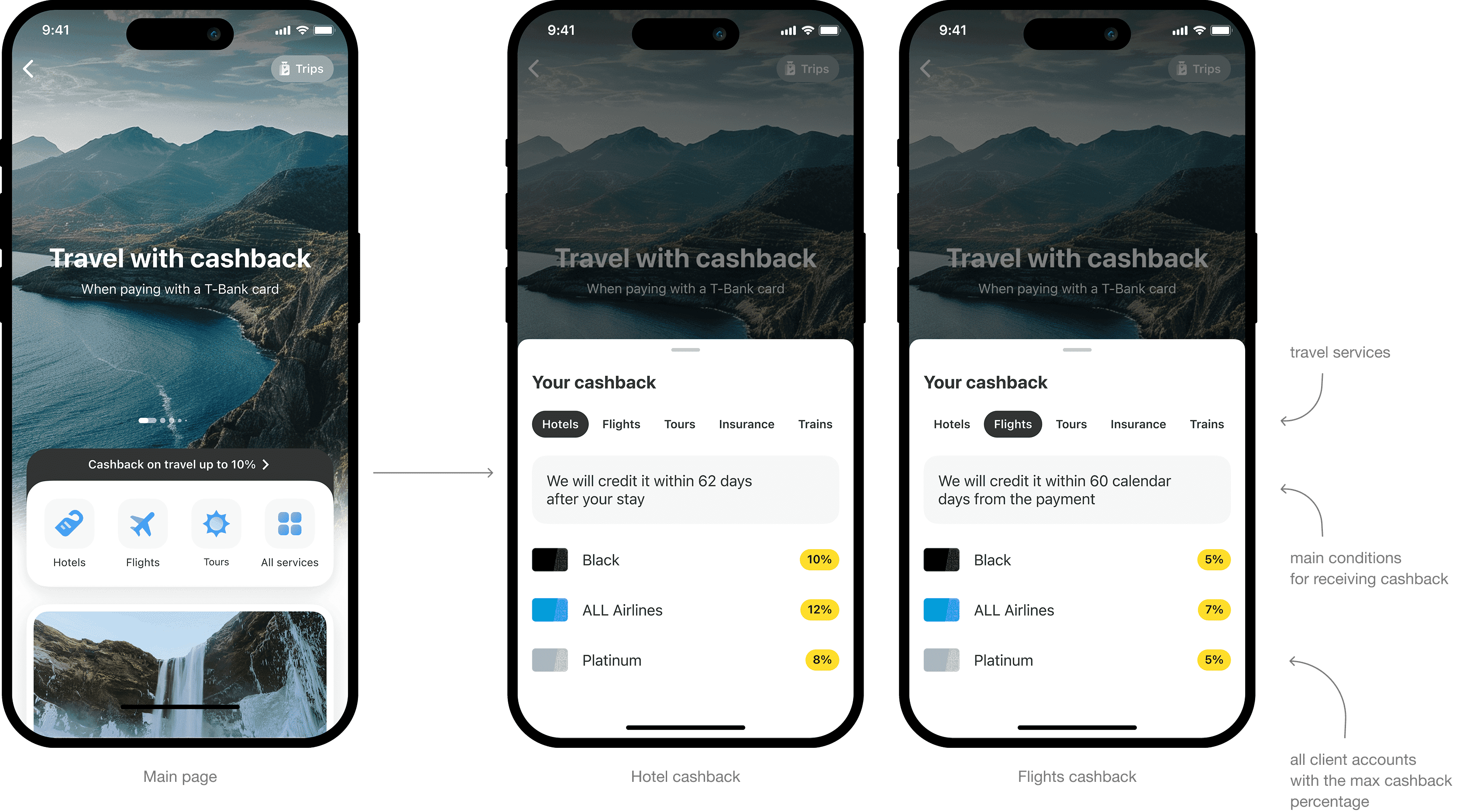

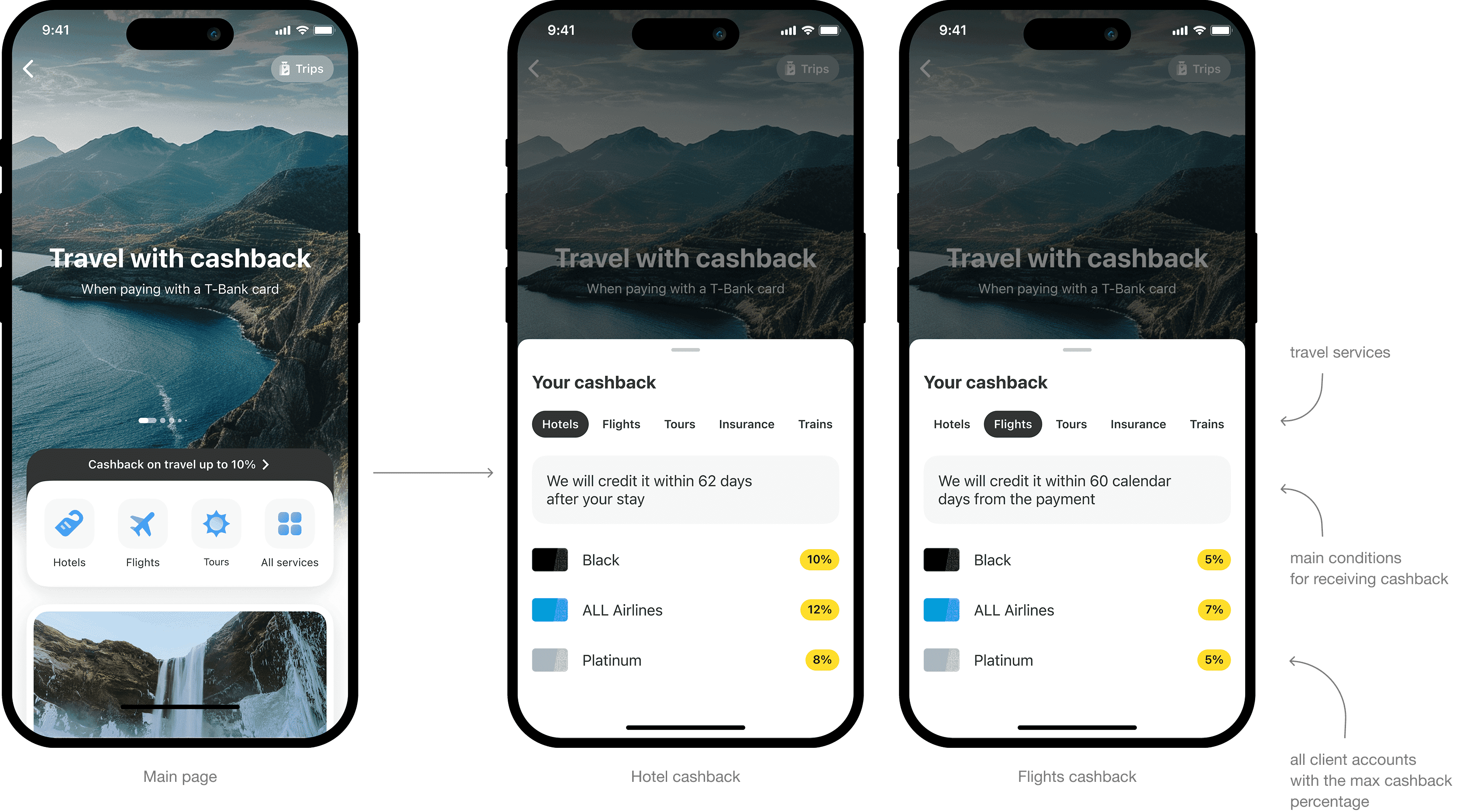

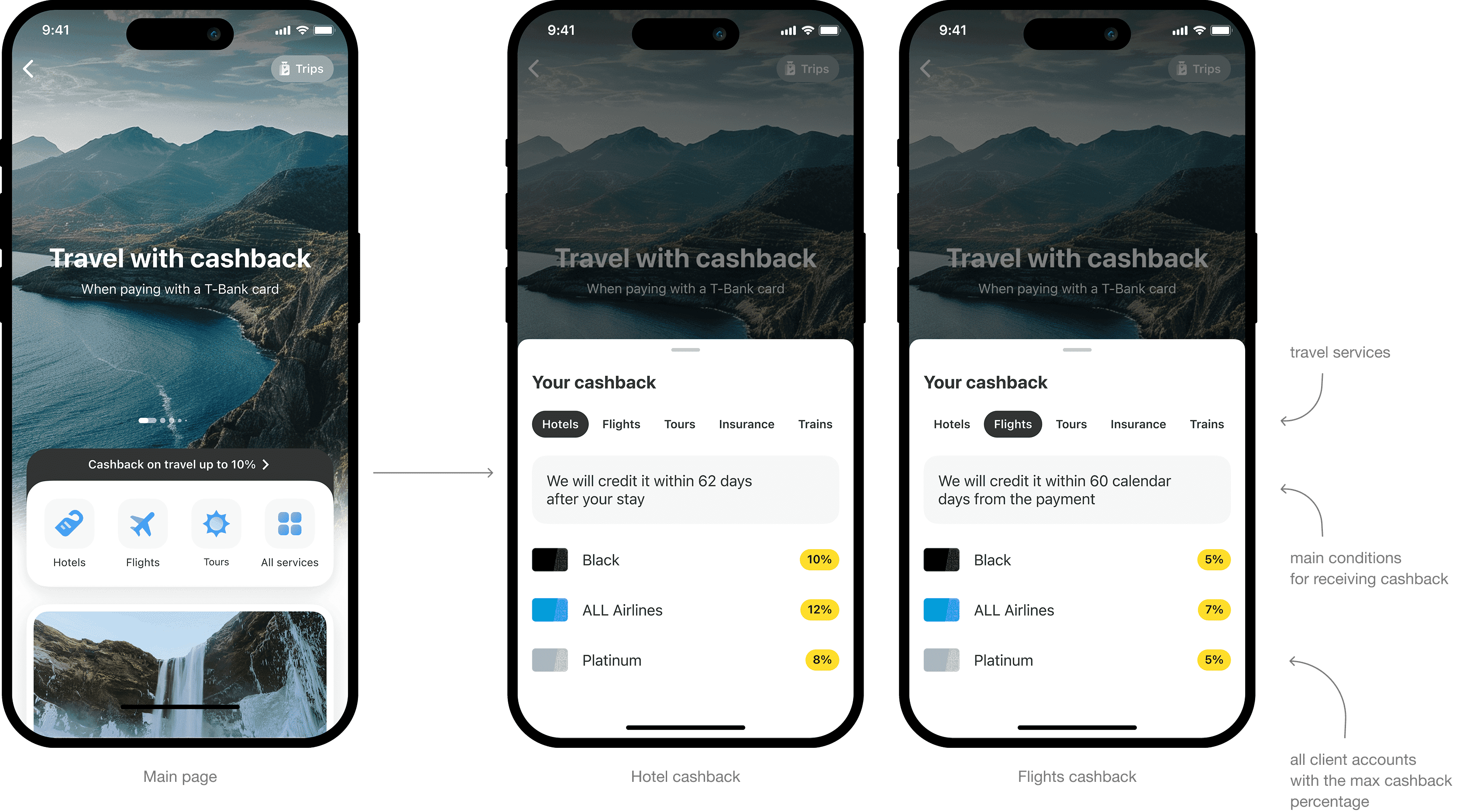

Introduced a Cashback widget on the homepage of the Travel. Embedded cashback information throughout the hotel booking flow, and standardized visuals for cashback display across all travel services.

Introduced a Cashback widget on the homepage of the Travel. Embedded cashback information throughout the hotel booking flow, and standardized visuals for cashback display across all travel services.

Introduced a Cashback widget on the homepage of the Travel. Embedded cashback information throughout the hotel booking flow, and standardized visuals for cashback display across all travel services.

Result

Result

Result

Conversion to booking from the hotel page increased, leading to overall order growth for the service.

Conversion to booking from the hotel page increased, leading to overall order growth for the service.

Conversion to booking from the hotel page increased, leading to overall order growth for the service.

About cashback

About cashback

About cashback

Cashback is real money or bonuses that a customer can receive for purchases made

with T-Bank cards. It is also one of the main unique selling propositions of the travel service at T-Bank.

Cashback is real money or bonuses that a customer can receive for purchases made

with T-Bank cards. It is also one of the main unique selling propositions of the travel service at T-Bank.

Cashback is real money or bonuses that a customer can receive for purchases made

with T-Bank cards. It is also one of the main unique selling propositions of the travel service at T-Bank.

What problems were there?

What problems were there?

What problems were there?

Firstly, cashback was not displayed in the travel flow. Customers could only find out the amount of their cashback at the checkout stage. Secondly, there was a heavy load on the travel technical support regarding cashback payout questions (about 30% of all inquiries). Thirdly, the drop-off rate from the hotel homepage was around 50%.

Firstly, cashback was not displayed in the travel flow. Customers could only find out the amount of their cashback at the checkout stage. Secondly, there was a heavy load on the travel technical support regarding cashback payout questions (about 30% of all inquiries). Thirdly, the drop-off rate from the hotel homepage was around 50%.

Firstly, cashback was not displayed in the travel flow. Customers could only find out the amount of their cashback at the checkout stage. Secondly, there was a heavy load on the travel technical support regarding cashback payout questions (about 30% of all inquiries). Thirdly, the drop-off rate from the hotel homepage was around 50%.

Thirdly, the bank did not have a unified solution for displaying cashback; all products operated independently and highlighted benefits in their own way. Therefore, this task became a great opportunity to explore the needs of different business lines and standardize cashback display across them.

Thirdly, the bank did not have a unified solution for displaying cashback; all products operated independently and highlighted benefits in their own way. Therefore, this task became a great opportunity to explore the needs of different business lines and standardize cashback display across them.

Thirdly, the bank did not have a unified solution for displaying cashback; all products operated independently and highlighted benefits in their own way. Therefore, this task became a great opportunity to explore the needs of different business lines and standardize cashback display across them.

p

Value of the solution

Value of the solution

Value of the solution

To increase customer loyalty and boost conversion to bookings.

To increase customer loyalty and boost conversion to bookings.

To increase customer loyalty and boost conversion to bookings.

Additional goal

Additional goal

Additional goal

To ensure a unified cashback display solution across different business lines.

To ensure a unified cashback display solution across different business lines.

To ensure a unified cashback display solution across different business lines.

Metrics we influence

Metrics we influence

Metrics we influence

✦ сonversion at each step of the core funnel

✦ increase in marketing orders from promotions and mailings

✦ сonversion at each step of the core funnel

✦ increase in marketing orders from promotions and mailings

✦ сonversion at each step of the core funnel

✦ increase in marketing orders from promotions and mailings

Success criteria

Success criteria

Success criteria

Increase loyalty. We will measure this using quantitative methods and feedback to technical support regarding cashback inquiries.

Increase loyalty. We will measure this using quantitative methods and feedback to technical support regarding cashback inquiries.

Increase loyalty. We will measure this using quantitative methods and feedback to technical support regarding cashback inquiries.

Discovery process

Discovery process

Discovery process

First, there was a stage of understanding the task:

✦ analysis of qualitative and quantitative research results that touched on the benefits topic

✦ analysis of customer feedback

✦ collection of current metrics

First, there was a stage of understanding the task:

✦ analysis of qualitative and quantitative research results that touched on the benefits topic

✦ analysis of customer feedback

✦ collection of current metrics

First, there was a stage of understanding the task:

✦ analysis of qualitative and quantitative research results that touched on the benefits topic

✦ analysis of customer feedback

✦ collection of current metrics

At this stage, problems were identified:

At this stage, problems were identified:

At this stage, problems were identified:

✦ about 30% of support inquiries were related to cashback, and these inquiries came not only after payment but also before payment, as customers did not understand which card to use to get more cashback

✦ about 30% of support inquiries were related to cashback, and these inquiries came not only after payment but also before payment, as customers did not understand which card to use to get more cashback

✦ about 30% of support inquiries were related to cashback, and these inquiries came not only after payment but also before payment, as customers did not understand which card to use to get more cashback

✦ approximately 50% of visitors dropped off from the homepage, one assumption was that when people do not understand the benefits of booking with us, they may go to other services

✦ approximately 50% of visitors dropped off from the homepage, one assumption was that when people do not understand the benefits of booking with us, they may go to other services

✦ approximately 50% of visitors dropped off from the homepage, one assumption was that when people do not understand the benefits of booking with us, they may go to other services

✦ from qualitative research, it was concluded that respondents only learned about the existence of cashback at the very last stage of the funnel

✦ from qualitative research, it was concluded that respondents only learned about the existence of cashback at the very last stage of the funnel

✦ from qualitative research, it was concluded that respondents only learned about the existence of cashback at the very last stage of the funnel

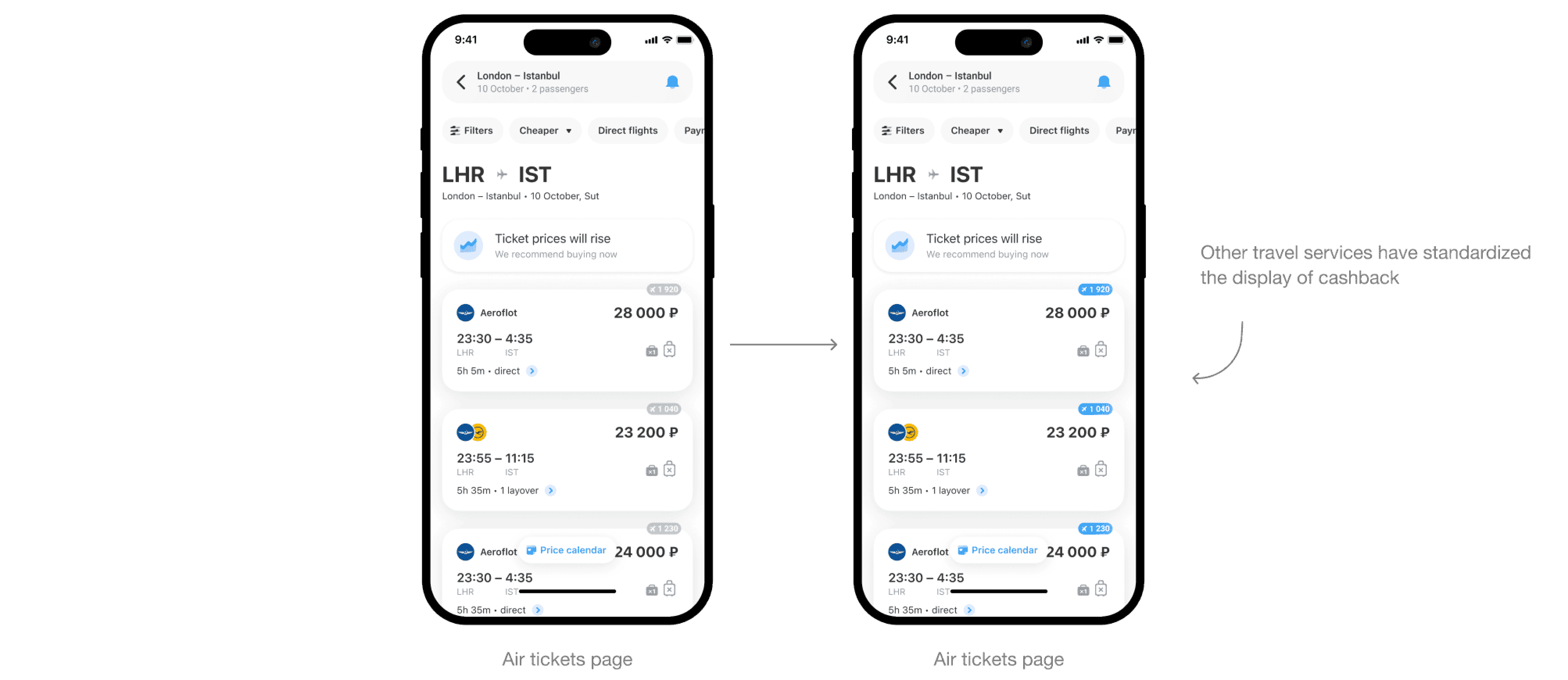

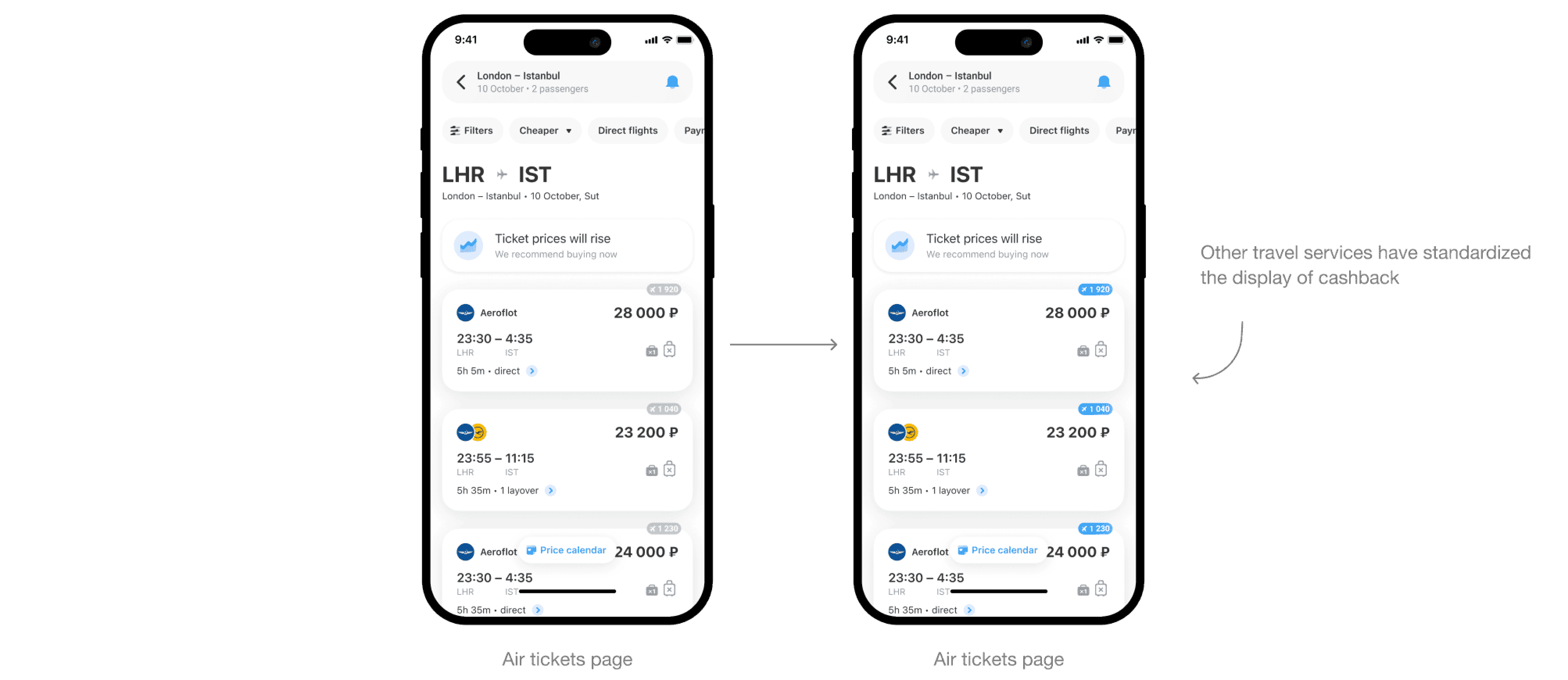

Looking at competitors' visuals didn't make much sense, as the bank already had quite a few variations of cashback displays. Therefore, the minimum plan was to understand why there were so many different variations and identify the most suitable one for the travel product. The maximum plan was to delve into the needs of different products and compile a general guide for displaying cashback that could be shared with other products.

Looking at competitors' visuals didn't make much sense, as the bank already had quite a few variations of cashback displays. Therefore, the minimum plan was to understand why there were so many different variations and identify the most suitable one for the travel product. The maximum plan was to delve into the needs of different products and compile a general guide for displaying cashback that could be shared with other products.

Looking at competitors' visuals didn't make much sense, as the bank already had quite a few variations of cashback displays. Therefore, the minimum plan was to understand why there were so many different variations and identify the most suitable one for the travel product. The maximum plan was to delve into the needs of different products and compile a general guide for displaying cashback that could be shared with other products.

Hypotheses

Hypotheses

Hypotheses

✦ if we show information about the customer's cashback throughout the flow, it could be one of the factors that encourages them to book a hotel through our service, leading to an increase in conversion rates at each stage of the funnel and boosting booking conversion

✦ if we show information about the customer's cashback throughout the flow, it could be one of the factors that encourages them to book a hotel through our service, leading to an increase in conversion rates at each stage of the funnel and boosting booking conversion

✦ if we show information about the customer's cashback throughout the flow, it could be one of the factors that encourages them to book a hotel through our service, leading to an increase in conversion rates at each stage of the funnel and boosting booking conversion

✦ if we show information about the conditions for earning cashback as early as possible, it will help customers understand what they need to do / which card to use to receive cashback, leading to an increase in conversion rates for bookings

✦ if we show information about the conditions for earning cashback as early as possible, it will help customers understand what they need to do / which card to use to receive cashback, leading to an increase in conversion rates for bookings

✦ if we show information about the conditions for earning cashback as early as possible, it will help customers understand what they need to do / which card to use to receive cashback, leading to an increase in conversion rates for bookings

✦ if a customer has multiple cards, we can provide the option to switch between their cards to compare potential benefits, which will increase loyalty and also boost the use of financial products (renewing subscriptions, prolonging the use of cards, for example, credit cards with higher cashback)

✦ if a customer has multiple cards, we can provide the option to switch between their cards to compare potential benefits, which will increase loyalty and also boost the use of financial products (renewing subscriptions, prolonging the use of cards, for example, credit cards with higher cashback)

✦ if a customer has multiple cards, we can provide the option to switch between their cards to compare potential benefits, which will increase loyalty and also boost the use of financial products (renewing subscriptions, prolonging the use of cards, for example, credit cards with higher cashback)

✦ if we show the customer not just the basic cashback but also immediately consider promotions applicable to them and explain their conditions, it will allow them to understand the terms and conditions of promotions without navigating to other sections of the bank, which will lead to increased customer loyalty

✦ if we show the customer not just the basic cashback but also immediately consider promotions applicable to them and explain their conditions, it will allow them to understand the terms and conditions of promotions without navigating to other sections of the bank, which will lead to increased customer loyalty

✦ if we show the customer not just the basic cashback but also immediately consider promotions applicable to them and explain their conditions, it will allow them to understand the terms and conditions of promotions without navigating to other sections of the bank, which will lead to increased customer loyalty

Together with the team, we reviewed, prioritized, and evaluated hypotheses. As a result, we divided the solution into iterations.

Together with the team, we reviewed, prioritized, and evaluated hypotheses. As a result, we divided the solution into iterations.

Together with the team, we reviewed, prioritized, and evaluated hypotheses. As a result, we divided the solution into iterations.

What we did

What we did

What we did

We launched the first iteration of cashback display in the flow. We added a static entry point on the homepage for information about cashback, showing all customer accounts and the amount of cashback the user could receive when purchasing a particular product. We explained the main conditions for receiving cashback.

We launched the first iteration of cashback display in the flow. We added a static entry point on the homepage for information about cashback, showing all customer accounts and the amount of cashback the user could receive when purchasing a particular product. We explained the main conditions for receiving cashback.

We launched the first iteration of cashback display in the flow. We added a static entry point on the homepage for information about cashback, showing all customer accounts and the amount of cashback the user could receive when purchasing a particular product. We explained the main conditions for receiving cashback.

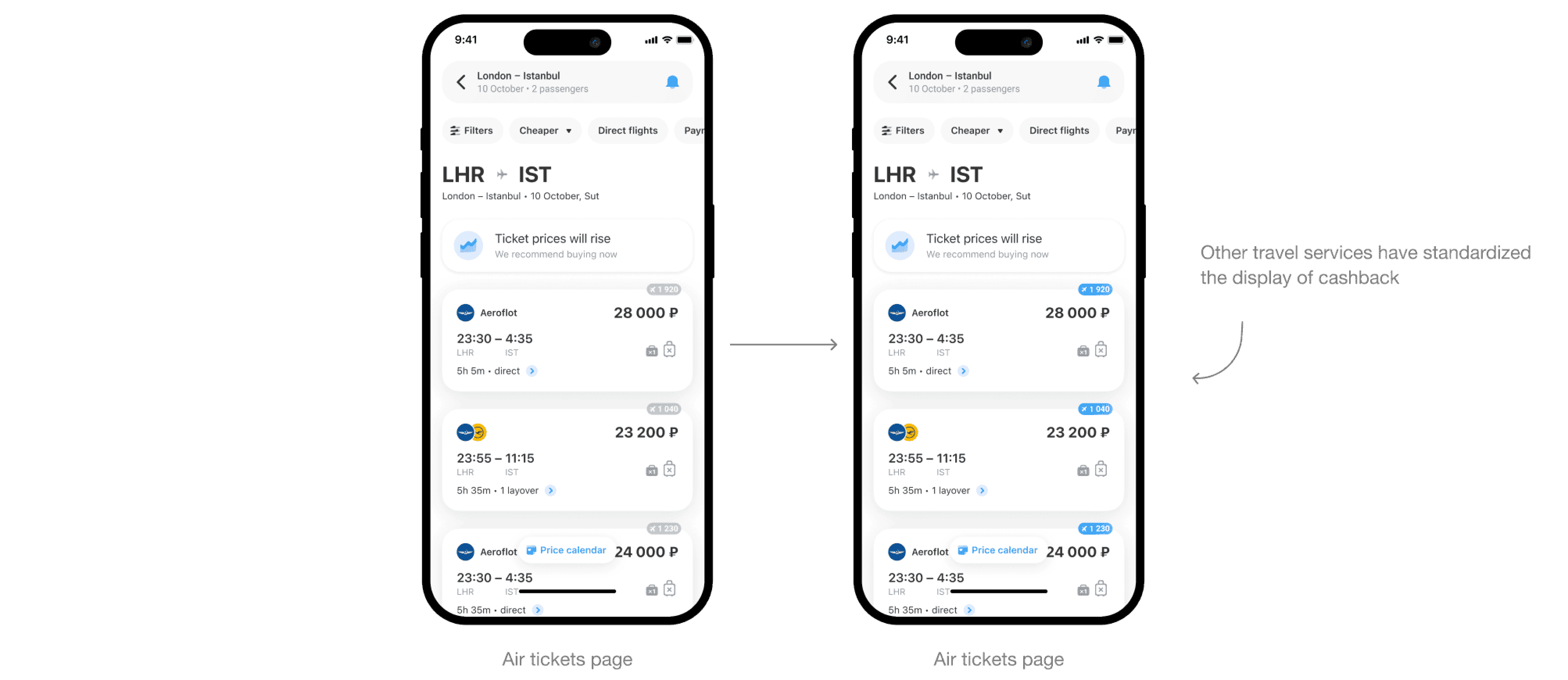

In hotels, cashback began to be displayed throughout the entire flow. In other travel services, we brought the visuals to a consistent look.

In hotels, cashback began to be displayed throughout the entire flow. In other travel services, we brought the visuals to a consistent look.

In hotels, cashback began to be displayed throughout the entire flow. In other travel services, we brought the visuals to a consistent look.

One of the important results of the task was the contribution to cross-team interaction. I gathered and defended a guide for displaying cashback, which increased consistency among T-Bank's non-financial services.

One of the important results of the task was the contribution to cross-team interaction. I gathered and defended a guide for displaying cashback, which increased consistency among T-Bank's non-financial services.

One of the important results of the task was the contribution to cross-team interaction. I gathered and defended a guide for displaying cashback, which increased consistency among T-Bank's non-financial services.

Results and next steps

Results and next steps

Results and next steps

Conversion to booking from the hotel page increased, leading to overall order growth for the service.

We continue to gather feedback from users and work on improvements. In the near future, we plan to:

✦ complete the development of the next iteration of the task

✦ experiment with highlighting benefits for the customer, identifying and retaining only those solutions that positively impact the metrics

Conversion to booking from the hotel page increased, leading to overall order growth for the service.

We continue to gather feedback from users and work on improvements. In the near future, we plan to:

✦ complete the development of the next iteration of the task

✦ experiment with highlighting benefits for the customer, identifying and retaining only those solutions that positively impact the metrics

Conversion to booking from the hotel page increased, leading to overall order growth for the service.

We continue to gather feedback from users and work on improvements. In the near future, we plan to:

✦ complete the development of the next iteration of the task

✦ experiment with highlighting benefits for the customer, identifying and retaining only those solutions that positively impact the metrics